Saturday, 30 March 2024

HOTEL VILLA FONTAINE PREMIER/GRAND HANEDA AIRPORT OFFERS ROOMS FEATURING POPULAR CHARACTERS

AM Best Revises Hanoi Re's ICR Outlook, Assigns National Scale Rating

KUALA LUMPUR, March 29 (Bernama) -- AM Best has revised the outlook to positive from stable for the long-term issuer credit rating (Long-Term ICR) and affirmed the financial strength rating (FSR) of B++ (Good) and the long-term ICR of “bbb” (Good) of Vietnam’s Hanoi Reinsurance Joint Stock Corporation (Hanoi Re).

The outlook of the FSR is stable and the global credit rating agency has assigned a Vietnam National Scale Rating (NSR) of aaa.VN (Exceptional) to Hanoi Re, formerly known as PVI Reinsurance Joint Stock Corporation (PVI Re), with a stable outlook.

The credit ratings (ratings) reflect Hanoi Re’s balance sheet strength, which AM Best assesses as strong, as well as its strong operating performance, limited business profile and appropriate enterprise risk management.

According to AM Best in a statement, the ratings also factor in rating enhancement from Hanoi Re’s ultimate parent, HDI Haftpflichtverband der Deutschen Industrie V.a.G. (HDI V.a.G.).

The revised Long-Term ICR outlook reflects an improving trend in Hanoi Re’s balance sheet strength fundamentals.

Correspondingly, the company’s risk-adjusted capitalisation, as measured by Best’s Capital Adequacy Ratio, improved to the strongest level in fiscal-year 2023 from a very strong level in fiscal-year 2022.

Notwithstanding, risk-adjusted capitalisation has shown moderate volatility in recent years driven by high dividend payouts and increasing capital requirements arising from business growth and investments.

AM Best views Hanoi Re’s operating performance as strong, supported by its five-year average return-on-equity ratio of 16.6 per cent (2019-2023), while underwriting results remained favourable in 2023, benefitting from profitable domestic business, which included business sourced from its sister company, PVI Insurance Corporation.

-- BERNAMA

Friday, 29 March 2024

TAIWAN'S NAN SHAN GENERAL RATED EXCELLENT - AM BEST

KUALA LUMPUR, March 29 (Bernama) -- Global credit rating agency, AM Best has affirmed the financial strength rating of A- (Excellent) and the long-term issuer credit rating of “a-” (Excellent) of Taiwan’s Nan Shan General Insurance Co Ltd (Nan Shan General).

The outlook of these credit ratings (ratings) is stable, reflecting Nan Shan General’s balance sheet strength, which AM Best assesses as very strong, as well as its adequate operating performance, neutral business profile and appropriate enterprise risk management.

Nan Shan General’s risk-adjusted capitalisation, as measured by Best’s Capital Adequacy Ratio, has significantly improved and is assessed as being at the very strong level as of year-end 2023, according to the credit rating agency in a statement.

The result is underpinned by the capital contribution of NT$1.5 billion in cash in 2023, from the company’s immediate parent, Nan Shan Life Insurance Co Ltd (Nan Shan Life), to restore Nan Shan General’s capital strength, following the large claims arising from pandemic insurance since 2022. (NT$100 = RM14.78)

Nan Shan General reported positive operating results last year, partially supported by the release of reserves provisions for pandemic insurance claims and positive investment performance, while its return on equity has been restored to a high single-digit level.

Having achieved double-digit growth on gross premiums written in 2023, mainly driven by expansions in voluntary motor, travel insurance and commercial lines, Nan Shan General has increased premium retention in the major voluntary motor line since 2023, which continues to be a major driver of the overall underwriting results.

With its bond portfolio continuing to contribute stable streams of interest income, which helped to partially offset volatility in equity investments during 2023, AM Best expects Nan Shan General to continue to focus on domestic fixed-income securities and maintain moderate exposure to equity securities with an aim to boost overall investment returns.

A wholly owned subsidiary of Nan Shan Life, the third-largest life insurance company in Taiwan in terms of total assets, Nan Shan General benefits from parental support in terms of the shared brand recognition, strong distribution support and operating and capital commitments.

-- BERNAMA

Wednesday, 27 March 2024

CHINESE SMART EV MAKER XPENG STEERS TOWARD GLOBAL MARKET VIA ASEAN PARTNERSHIPS

Tuesday, 26 March 2024

AIM SYSTEMS DRIVES FACTORY AUTOMATION WITH GEN 2 AI-INTEGRATED MES, MCS PLATFORMS

The upcoming second-generation MES and MCS products are being developed not only to actively utilise artificial intelligence (AI) but also to enhance operation and monitoring systems, making it significantly easier for customers to improve yield and establish intelligent factory automation.

This development aims to clearly differentiate from the existing first-generation products which were localised in the early 2000s, according to aim Systems in a statement.

In particular, the defence industry is currently shifting towards incorporating AI to enhance yield and hence the market anticipates that products similar to the company’s new MES/Equipment Automation Systems (EAS)/MCS will benefit from such trend.

With the advent of the intensified competition in high-tech industry, investments and expansions in display and semiconductor factories have become essential.

To efficiently manage large display and semiconductor factories, core software such as MES, EAS and MCS also need to evolve to keep abreast with technological changes including AI.

Established in 1996, aim Systems has significantly reduced costs for domestic hi-tech companies through localisation of MES for semiconductor/display factories, and retains over 30 research and development experts who are the key for its advanced technological expansion.

-- BERNAMA

Saturday, 23 March 2024

R. DANE MAULDIN TAKES THE HELM AS NIQ CHIEF TRANSFORMATION OFFICER

Friday, 22 March 2024

AM BEST AFFIRMS CREDIT RATINGS OF SUN HUNG KAI PROPERTIES INSURANCE LIMITED

The ratings reflect SHKPI’s balance sheet strength, which AM Best assesses as very strong, as well as its strong operating performance, neutral business profile and appropriate enterprise risk management.

SHKPI’s very strong balance sheet strength assessment is underpinned by its risk-adjusted capitalisation at the strongest level, as measured by Best’s Capital Adequacy Ratio (BCAR). The company’s higher-risk financial assets, including unlisted investments and non-investment-grade bonds, exposed its risk-adjusted capitalisation to considerable market and credit risks. Nonetheless, the company has de-risked the majority of its bond exposure to mainland China’s real estate sector in fiscal year 2023, with its bond portfolio demonstrating an improvement in the credit quality with higher diversification level. AM Best considers SHKPI’s capital level provides a sufficient buffer to absorb investment risks. Other supporting factors include the company’s strong liquidity position and appropriate reinsurance programme, with a diversified panel of financially sound reinsurers.

SHKPI has consistently delivered a strong operating performance over the past few years. Its net profit in fiscal year 2023 was a combined result of a recovery in investment performance and stable underwriting profit. SHKPI continues to benefit from its parent company’s support, both in distribution channels with minimal gross acquisition expenses as well as in access to better quality group business, leading to its favourable underwriting results. The company’s investment returns turned positive in fiscal year 2023, mainly driven by favourable interest income owing to a high interest rate environment.

SHKPI is a wholly owned subsidiary of Sun Hung Kai Properties Limited, one of the largest property development and investment conglomerates in Hong Kong. It benefits from its parental network to write a major part of its business from associated and subsidiary companies. The company continues to operate in a low acquisition cost business model while seeking new business opportunities within the market. SHKPI maintains a small albeit profitable presence in Hong Kong’s general insurance market, focusing on employees’ compensation insurance on a net premiums written basis.

Negative rating actions could occur if there is significant deterioration in SHKPI’s operating performance; for example, due to lower investment returns or weakened underwriting results. Negative rating actions also could arise if there is a significant deterioration in SHKPI's risk-adjusted capitalisation, for example, due to material investment losses. Although it is unlikely in the near term, positive rating actions could arise if there is significant improvement in SHKPI's risk-adjusted capitalisation, for example, due to further improvements in asset quality and capital size.

Ratings are communicated to rated entities prior to publication. Unless stated otherwise, the ratings were not amended subsequent to that communication.

This press release relates to Credit Ratings that have been published on AM Best’s website. For all rating information relating to the release and pertinent disclosures, including details of the office responsible for issuing each of the individual ratings referenced in this release, please see AM Best’s Recent Rating Activity web page. For additional information regarding the use and limitations of Credit Rating opinions, please view Guide to Best’s Credit Ratings. For information on the proper use of Best’s Credit Ratings, Best’s Performance Assessments, Best’s Preliminary Credit Assessments and AM Best press releases, please view Guide to Proper Use of Best’s Ratings & Assessments.

AM Best is a global credit rating agency, news publisher and data analytics provider specialising in the insurance industry. Headquartered in the United States, the company does business in over 100 countries with regional offices in London, Amsterdam, Dubai, Hong Kong, Singapore and Mexico City. For more information, visit www.ambest.com.

Copyright © 2024 by A.M. Best Rating Services, Inc. and/or its affiliates. ALL RIGHTS RESERVED.

View source version on businesswire.com:

https://www.businesswire.com/news/home/20240321317665/en/

Contact

Aaron Li

Associate Financial Analyst

+852 2827 3426

aaron.li@ambest.com

Christopher Sharkey

Associate Director, Public Relations

+1 908 882 2310

christopher.sharkey@ambest.com

Lucie Huang

Senior Financial Analyst

+852 2827 3414

lucie.huang@ambest.com

Al Slavin

Senior Public Relations Specialist

+1 908 439 2318

al.slavin@ambest.com

Source : AM Best

Wednesday, 20 March 2024

Stellar Cyber Regional Success Attributable Largely From DXC Technology Partnership

KUALA LUMPUR, March 19 (Bernama) -- Stellar Cyber, the innovator of Open extended detection and response (XDR) for security operations, announced DXC Technology as its 2023 Asia Pacific GSI Partner of the Year.

According to a statement, Stellar Cyber has seen significant growth in awareness and adoption of Open XDR throughout the Asia Pacific region, since partnering with DXC.

“DXC’s commitment to providing managed security services that help organisations keep their sensitive information secure aligns perfectly with the Stellar Cyber philosophy for delivering comprehensive security coverage.

“With DXC, we knew we had the right partner to deliver Open XDR effectively for customers in Asia Pacific, and we look forward to a long-lasting, mutually-productive relationship,” said Stellar Cyber Vice President of Sales, ASEAN and ANZ, Dominic Neo.

DXC is a Fortune 500 information technology service provider committed to delivering world-class services for its enterprise and government customers, and with six differentiated offerings, DXC enables organisations to meet a wide range of technology challenges.

Meanwhile, DXC Security, one of the six offerings, focuses on helping organisations deliver comprehensive security across the enterprise.

Based in Silicon Valley, Stellar Cyber delivers comprehensive, unified security without complexity, empowering lean security teams of any skill to secure their environments successfully.

-- BERNAMA

Friday, 15 March 2024

NEW ZEALAND’S FIDELITY LIFE ASSURANCE RATINGS AFFIRMED EXCELLENT - AM BEST

These credit ratings (ratings), which have a stable outlook reflect Fidelity Life Assurance’s balance sheet strength, that AM Best assesses as very strong, as well as its adequate operating performance, neutral business profile and appropriate enterprise risk management.

Fidelity Life Assurance’s balance sheet strength assessment is underpinned by its risk-adjusted capitalisation, which is at the strongest level as of fiscal year ending June 30, 2023, as measured by Best’s Capital Adequacy Ratio.

The company has a robust capital management strategy that supports a solid regulatory solvency position, as well as the maintenance of risk-adjusted capitalisation at the strongest level over the medium term.

In a statement, AM Best said the ratings partially offsetting balance sheet strength factor is Fidelity Life Assurance’s high reliance on third-party reinsurance.

AM Best also views Fidelity Life Assurance as having good financial flexibility, supported by its two largest shareholders, NZ Superannuation Fund and Ngāi Tahu Holdings Corporation Limited.

Over the past two fiscal years, operating earnings were dampened due to elevated integration and transaction costs associated with the acquisition of Westpac Life-NZ- Limited (subsequently renamed to Fidelity Insurance Limited [Fidelity Insurance]).

However, AM Best expects operating performance metrics to improve prospectively, supported by scale efficiencies arising from the group’s increased operational size, as well as enhanced technological capabilities.

Fidelity Life Assurance ranks among the largest life insurance companies in New Zealand, recording significant premium growth following the acquisition of Fidelity Insurance in fiscal year 2022.

The insurance policies are distributed predominantly through financial advisers and Westpac New Zealand Limited’s banking network, with an exclusive 15-year distribution arrangement with the bank.

-- BERNAMA

Thursday, 14 March 2024

BLACK & VEATCH TO PROVIDE CONCEPT DESIGNS FOR H2EX'S NATURAL HYDROGEN, HELIUM PROJECT

KUALA LUMPUR, March 14 (Bernama) -- Black & Veatch, a global leader in critical infrastructure solutions, will study the exploration and extraction of natural hydrogen and helium in Australia.

The development study is an engineering services agreement between Australian-owned natural hydrogen company H2EX Limited, a world leader in exploring naturally occurring hydrogen, and Black & Veatch.

According to Black & Veatch in a statement, the objective of the study is to unlock first-mover benefits for Australia within an emerging sector globally, as well as create substantial local and export opportunities while retaining the country’s competitive advantage and technical and engineering expertise.

Black & Veatch managing director, Strategic Growth, Global Advisory, Yatin Premchand said decarbonisation efforts in the Asia Pacific were a priority for the company, which include extracting natural hydrogen, a potential clean energy source for the region.

The company will provide two concept designs on H2EX’s exploration licence PEL 691 on the Eyre Peninsula in South Australia as part of the development study.

One concept design will be for the drilling and completion of an exploration well, while the other will be for surface facilities to purify, process and deliver natural hydrogen and helium, including co-production of the resources, if they are found together.

Black & Veatch will also analyse gas industry practices related to conventional well drilling and extraction infrastructure and identify key considerations to adapt these practices for natural hydrogen and helium.

The research into extraction solutions will provide a pathway to drill and extract the lowest-cost hydrogen, which could be up to 75 percent more cost-effective than manufacturing hydrogen.

Estimated to complete by mid-2024, the study is partly funded by Australia’s Federal Department of Science and Innovation via its Cooperative Research Council Projects (CRC-P) Grants Round 14 initiative led by H2EX, that supports short-term, industry-led research collaborations.

-- BERNAMA

AMENDED LAW TO AFFECT VIETNAM'S BANCASSURANCE SALES - AM BEST

According to a new AM Best report, amendments to Vietnam’s Law on Credit Institutions is geared toward improving financial conduct and restoring consumer confidence in the country’s bancassurance channel.

The new law takes effect in July and focuses primarily on credit institutions such as banks, foreign bank branches and leasing companies operating in Vietnam; however, it includes a restriction prohibiting credit institutions from bundling the sale of non-compulsory insurance products alongside any financial services.

The amended law is expected to benefit consumers by giving policyholders the ability to choose only products they require at competitive prices, thus AM Best expects that the regulatory shift will generate near-term headwinds for Vietnam’s insurers.

“Bancassurance is an important distribution channel, especially for the life segment, accounting for approximately 20 per cent of total life insurance premiums and 14 per cent of total non-life insurance revenue in 2022.

“Some insurers derive a higher proportion of premiums from bancassurance due to strategic partnerships or corporate affiliations with banking groups,” said AM Best senior financial analyst, Ken Lau in a statement.

Business acquired through Vietnam’s bancassurance channel has grown considerably in the run-up to 2023, owing to rising insurance demand, economic growth and increased tie-ups between banks and insurance companies.

However, following complaints from the clients of banks and insurance companies related to unfair sales practices and the subsequent regulatory scrutiny, revenue sourced through bancassurance may have peaked and many banks reported double-digit declines in revenue from insurance services in the first three quarters of 2023 from the prior year period.

Headquartered in the United States and does business in over 100 countries, AM Best is a global credit rating agency, news publisher and data analytics provider specialising in the insurance industry.

-- BERNAMA

Wednesday, 13 March 2024

BEEWORKS GAMES "IDLE MUSHROOM GARDEN DELUXE" NOW AVAILABLE IN ENGLISH

KUALA LUMPUR, March 13 (Bernama) -- Japanese mobile-game developer Beeworks Games has released the English version of its app “Idle Mushroom Garden Deluxe” on the Google Play/App Store.

According to a statement, the release comes on the heels of the success of its previous title “Mushroom Garden Prime”, which garnered over half a million downloads in just two months.

Beeworks Games Marketing Director, Kristofer Chan said the company was overwhelmed by the amount of positive support its first app received and looked forward to providing global users even more fun content in future.

“Idle Mushroom Garden Deluxe” is a casual farming simulator, featuring the cute and quirky character “Funghi”. With just a single tap, users may apply food to their log and wait as the Funghi grow and once the log is full of Funghi, it can be harvested by simply swiping across the screen.

With 29 different logs to choose from, and over 700 different Funghi to discover, “Idle Mushroom Garden Deluxe” has even more content than its predecessor.

In addition to farming, users can decorate and display their favourite Funghi in the “Cardboard Room”, or complete missions to receive useful items.

First released in 2011, the mushroom farming simulator with its loveable Funghi character has accumulated over 60 million downloads worldwide, in which the series is particularly popular in Japan and has also found success, especially in South Korea, Taiwan, and the United States.

-- BERNAMA

MITSUBISHI CORPORATION LIFE SCIENCES REVEALS CYSTEINE PEPTIDE INGESTION EFFECT ON SKIN BRIGHTNESS

KUALA LUMPUR, March 13 (Bernama) -- Mitsubishi Corporation Life Sciences Limited has published a new clinical study regarding the effect of ingestion of cysteine peptide containing glutathione on skin brightness.

In this study, the company defined glutathione (GSH), cysteinylglycine (Cys-Gly), and glutamylcysteine (-Glu-Cys) as cysteine peptide to investigate the effects of orally administered cysteine peptide on human skin brightness.

Mitsubishi Corporation Life Sciences in a statement said this study was designed to be a randomised, double-blind, placebo-controlled, parallel-group comparative study with healthy males and females aged between 20 and 65 years old.

Eligible participants were randomly allocated into three groups, with each subject ingested six tablets every day for 12 weeks, and skin brightness was measured using a portable spectrophotometer at screening, week zero, week four, week eight and week 12.

The result revealed that all groups showed a significant difference in arm brightness at 12 weeks compared to zero week.

The study showed that the group who orally took the cysteine peptide at 45 milligrammes (mg) for 12 weeks exhibited arm brightening in a time-dependent manner, and a significant difference was observed compared to the placebo at week 12.

Mitsubishi Corporation Life Sciences has an affiliate of KOHJIN Life Sciences, the manufacturer of Glutathione located in Japan with a history of over 70 years of production and it continues to strive towards the realisation of new value creation.

-- BERNAMA

STERLING TRADING TECH EXPANDS OMS, RISK SOLUTIONS TO ASIA

KUALA LUMPUR, March 13 (Bernama) -- Sterling Trading Tech (STT), a professional trading technology solutions provider announced its 2024 expansion into Asia, with Korea, Hong Kong, and Singapore chosen as the expansion's focal points.

According to a statement, this announcement comes as the second in a series of this year’s strategic announcements regarding plans for international expansion, following the recent onboarding of KBFG Securities America Inc.

STT Chief Executive Officer, Jennifer Nayar said: “What sets us apart in the industry is our multi-asset OMS, delivering 24x5 capabilities, and our Risk system, built with unmatched regulatory features to provide a distinct competitive advantage.

“Our experience is that Asia markets consistently seek the most capable and advanced solutions to build their franchises and we have already gained traction with our approach.”

The move is in response to the Asia markets and client demand for more advanced order management system (OMS) and Risk solutions than are currently available in local markets.

STT will deploy its systems both locally and cross-border, focusing on the United States (US) operations of Asia entities, whereby its multi-asset OMS enhances liquidity and alpha generation in US equities and options, fosters client growth and competitiveness by creating operational and infrastructure efficiencies.

Its OMS offers real-time balances and positions, advanced margin methodologies, customisable risk controls, broad reporting capabilities, and application programming interface (API) connectivity, enabling seamless trading.

Advanced order queueing allows traders to place orders at any time and receive international orders in real time outside of US trading hours.

With over 100 clients in over 20 countries, STT focuses on client growth by delivering technology that provides clients with a competitive advantage.

-- BERNAMA

SMARTSTREAM UNVEILS ENHANCED DERIVATIVES DATA FOR EMIR REFIT STANDARDS

According to SmartStream in a statement, this expansion is crucial for meeting the European Market Infrastructure Regulation (EMIR) Refit reporting requirements.

“The main challenges posed by this regulation, include completing the numerous new reportable fields for commodity and energy derivatives. Also to protect firms from poor-quality and inaccessible data, in addition to addressing regulators' demands for increased complexity within certain commodity and energy contracts.

“My advice to all market participants is to be prepared and deploy the necessary technology to ensure the highest data quality to mitigate the risk of fines and reputational damage,” said SmartStream RDS Executive Vice President, Linda Coffman.

The EMIR Refit initiative, set to take effect in April for Europe and September for the United Kingdom, is geared towards enhancing transparency and stability in the over-the-counter (OTC) derivatives trading market.

A significant concern within the industry and among participants revolves around identifying unexpected data quality issues and navigating the complexities of reporting fields, particularly concerning commodity and energy derivatives.

Financial institutions are actively seeking reliable and efficient methods to manage their securities reference data to meet these new requirements.

Therefore, with RDS, additional attributes will be integrated into the RDS’s Listed Derivatives service and a standalone OTC Derivatives service to support the full spectrum of reference data needed for commodity transactions under the new EMIR regulation.

SmartStream RDS, renowned for delivering quality reference data as a managed service, will leverage its deep trade lifecycle expertise and highly skilled resources to provide accurate data and customised regulatory operations tailored to each financial institution, ensuring compliance with the new EMIR Refit standards.

-- BERNAMA

Thursday, 7 March 2024

8x8 Solution Supercharges King Power's E-commerce Platform

KUALA LUMPUR, March 6 (Bernama) -- 8x8 Inc announced that King Power Corporation has integrated the company’s SMS API solution into their e-commerce platform to enhance customer experiences while effectively reducing 30 per cent operational costs by driving efficiency and cost savings.

“At 8x8, we remain committed to delivering cutting-edge communication solutions that empower businesses to achieve their operational objectives efficiently and drive impressive cost-savings initiatives such as King Power Corporation was able to achieve,” said 8x8 Inc General Manager, CPaaS, Stephen Hamill in a statement.

Meanwhile, King Power Corporation Vice President of Digital Delivery Management, Boonthavee Jarudomrongsak said: “With 8x8, we are able to provide our customers with an elevated e-commerce experience they want and have come to expect from King Power Corporation, both on our website and the app.”

King Power Corporation, one of the largest duty-free retailers in the world, sought a strategic partner to optimise its e-commerce operations by elevating customer and employee communication experiences.

Additionally, the company needed a communications solution that provided scalable and cost-effective support, hence it selected the 8x8 SMS API, enabling it to efficiently reach customers anywhere, anytime by automating notifications, one-time passwords, reminders and alerts.

Since deploying the 8x8 SMS API, King Power Corporation has experienced improvements in short message service (SMS) delivery rates, further optimised its e-commerce platform by facilitating smoother processing of orders, customer verifications, and timely SMS notifications via its e-commerce platform.

8x8 Communications Platform as a Service (CPaaS), which includes SMS, messaging apps, voice, and video interaction, serves as a key enabler of business communications and customer experience in an ever-evolving digital transformation.

-- BERNAMA

WOLTERS KLUWER'S ONESUMX HONOURED FOR EXCELLENCE IN FINANCIAL COMPLIANCE

Wednesday, 6 March 2024

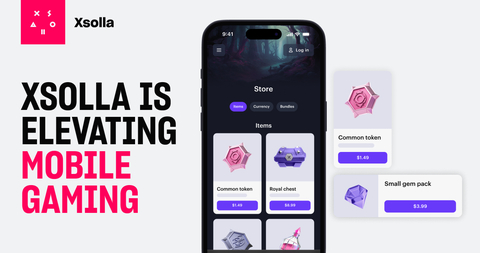

XSOLLA UNVEILS WEB SHOP 2.0, A LEADING SOLUTION FOR WEB PURCHASES, TO POWER PROFITABLE DIRECT-TO-CONSUMER SALES FOR GAME DEVELOPERS

(Graphic: Xsolla)

Web Shops are white label digital stores where players purchase in-game items, currencies, and top up their accounts, all from the developers branded website

LOS ANGELES, March 6 (Bernama-BUSINESS WIRE) -- Xsolla, a video game commerce company, has introduced Xsolla Web Shop 2.0. Since Xsolla's focus on web monetization began in 2021, Xsolla has launched 210+ Web Shops for leading mobile studios worldwide across multiple genres. Drawing on this extensive experience, Xsolla has been building a new, innovative version of its flagship solution, Web Shop, designed to help mobile game developers construct direct-to-consumer monetization strategies to increase revenue by motivating gamers to pay on the web.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20240305610432/en/

With this release, Xsolla is unveiling the Instant Web Shop, a templatized online store fully functional to power web purchases in as little as 24 hours. This rapid deployment tool for starting immediate revenue collection improves user awareness of the advantages of making purchases on the web. As a next step, once the value hypothesis is validated, developers can build a comprehensive LiveOps system with Web Shop LiveOps tools for sales management.

Xsolla Web Shop 2.0 Features:

- Advanced LiveOps Tools: Includes A/B testing, featured offers, first purchase offers, secret shop promotions, coupons, promo codes, and both time-limited and number-limited offers. These tools enable developers to craft highly valuable player experiences.

- Personalization and Engagement: Through personalized offers, discount promotions, bonus promotions, a loyalty program, and a reward system developers can significantly increase player engagement and loyalty.

- Expert Guidance and Support: Xsolla provides expert guidance in navigating the intricacies of web shop management, empowering partners to maximize their earnings.

- Improved User Flow: seamless, one-click payments with Xsolla Wallet, PWA (Progressive Web Application) and Deeplink Authentication.

For more information about Xsolla Web Shop 2.0 and its features, please visit: xsolla.pro/webshop-2

About Xsolla

Xsolla is a global video game commerce company with a robust and powerful set of tools and services designed specifically for the industry. Since its founding in 2005, Xsolla has helped thousands of game developers and publishers of all sizes fund, market, launch and monetize their games globally and across multiple platforms. As an innovative leader in game commerce, Xsolla’s mission is to solve the inherent complexities of global distribution, marketing, and monetization to help our partners reach more geographies, generate more revenue, and create relationships with gamers worldwide. Headquartered and incorporated in Los Angeles, California, with offices in London, Berlin, Seoul, Beijing, Kuala Lumpur, Raleigh, Tokyo, and cities around the world, Xsolla supports major gaming titles like Valve, Twitch, Roblox, Epic Games, Take-Two, KRAFTON, Nexters, NetEase, Playstudios, Playrix, miHoYo, and more.

For additional information and to learn more, please visit: xsolla.com

View source version on businesswire.com:

https://www.businesswire.com/news/home/20240305610432/en/

Contact

Derrick Stembridge

Global Director of Public Relations, Xsolla

d.stembridge@xsolla.com

Source : Xsolla

Tuesday, 5 March 2024

TRAVEL + LEISURE CO COMPLETES ACCOR VACATION CLUB ACQUISITION

AM Best Affirms ICICI Lombard Credit Ratings

KUALA LUMPUR, March 4 (Bernama) -- Global credit rating agency, AM Best has affirmed India’s ICICI Lombard General Insurance Company Limited (ICICI Lombard) financial strength rating of B++ (Good) and the long-term issuer credit rating of “bbb+” (Good).

Concurrently, the credit rating agency has assigned the India National Scale Rating (NSR) of aaa.IN (Exceptional) to ICICI Lombard, with the outlook to these credit ratings (ratings) stable.

In a statement, AM Best said the ratings reflected ICICI Lombard’s balance sheet strength, which was assessed as very strong, as well as its strong operating performance, neutral business profile and appropriate enterprise risk management.

The company’s robust regulatory solvency position is supported by a track record of strong internal capital generation, with shareholders’ equity having exhibited a five-year average compound annual growth rate of 15 per cent, as calculated by AM Best (fiscal-years 2019-2023).

In addition, AM Best views the company as having strong financial flexibility as demonstrated by its track record of capital raising activities.

An offsetting balance sheet strength factor remains ICICI Lombard’s moderate-risk investment portfolio, which includes significant exposure to equities and fixed income securities that are non-rated on an international rating scale.

The company’s operating performance was also viewed as strong, with a five-year average return-on-equity ratio of 18.2 per cent, as measured by AM Best (fiscal-years 2019-2023), with robust overall operating results, albeit reliant on investment income (including capital gains) to offset underwriting losses.

Although ICICI Lombard’s five-year average combined ratio was 104.8 per cent, it has consistently outperformed the domestic general insurance market in India. Underwriting performance improved in fiscal-year 2023, mainly driven by a reduction in COVID-19 claims from the health business.

ICICI Lombard is the second-largest non-life general insurer in India, with an overall market share of 8.2 per cent based on fiscal-year 2023’s gross domestic premium income, and is anticipated to enhance its underwriting risk selection via the adoption of technology and analytics.

-- BERNAMA

Saturday, 2 March 2024

ST KITTS AND NEVIS TO HOST MAIDEN INVESTMENT GATEWAY SUMMIT TOWARDS A SUSTAINABLE FUTURE

Friday, 1 March 2024

AM BEST AFFIRMS CREDIT RATINGS OF PACIFIC INTERNATIONAL INSURANCE PTY LIMITED

The ratings reflect Pacific’s balance sheet strength, which AM Best assesses as adequate, as well as its adequate operating performance, limited business profile and appropriate enterprise risk management (ERM). These ratings also factor in a neutral impact from Pacific’s ultimate owner, Badger Mutual Wealth (Pty) Ltd (the Badger group), an insurance group domiciled in South Africa.

The company’s balance sheet strength assessment is underpinned by risk-adjusted capitalisation, which was at the strong level in fiscal-year ending 30 June 2023, as measured by Best’s Capital Adequacy Ratio (BCAR). Prospective risk-adjusted capitalisation is expected to remain at least at the strong level over the medium term. However, Pacific’s capital adequacy remains sensitive to the successful execution of its business plan, which includes its performance targets and projected capital generation. The company is viewed as having robust financial flexibility, with capital injections totalling AUD 37 million over the last five fiscal years to support the growth of the operation. Prospectively, shareholder support is expected to be forthcoming, if needed. A partially offsetting factor is Pacific’s moderate dependence on reinsurance for new business opportunities; however, the risk associated with this dependence is partly mitigated by the good credit quality of the reinsurance panel.

AM Best views Pacific’s operating performance as adequate. Over the last five years, the company’s operating performance exhibited a notable positive trend, recording a five-year average return-on-equity ratio of -0.2% (fiscal-years 2019-2023). Following the Badger group’s acquisition in fiscal-year 2018, Pacific recorded elevated expenses due to significant investments in marketing and infrastructure. Nevertheless, as a result of increased operational scale and cost saving initiative in recent years, the company reported positive earnings in both fiscal-years 2022 and 2023.

AM Best assesses Pacific’s business profile as limited. This reflects its relatively modest scale of operations. The company recorded elevated premium growth in recent years, with a large proportion of this premium being ceded out to reinsurers. Pacific’s net retained insurance portfolio predominantly consists of motor and a motor novated lease partnership with an insurance distributor. AM Best expects Pacific’s net underwriting growth to be elevated over the medium term, driven by pet cover and travel lines of business.

AM Best assesses Pacific’s ERM as appropriate, given the size, nature and the complexity of its operations. Nonetheless, AM Best views ongoing strengthening of the company’s ERM capabilities as necessary to support its increasing operational scale and widened product offering in the near to medium term.

Ratings are communicated to rated entities prior to publication. Unless stated otherwise, the ratings were not amended subsequent to that communication.

This press release relates to Credit Ratings that have been published on AM Best’s website. For all rating information relating to the release and pertinent disclosures, including details of the office responsible for issuing each of the individual ratings referenced in this release, please see AM Best’s Recent Rating Activity web page. For additional information regarding the use and limitations of Credit Rating opinions, please view Guide to Best’s Credit Ratings. For information on the proper use of Best’s Credit Ratings, Best’s Performance Assessments, Best’s Preliminary Credit Assessments and AM Best press releases, please view Guide to Proper Use of Best’s Ratings & Assessments.

AM Best is a global credit rating agency, news publisher and data analytics provider specialising in the insurance industry. Headquartered in the United States, the company does business in over 100 countries with regional offices in London, Amsterdam, Dubai, Hong Kong, Singapore and Mexico City. For more information, visit www.ambest.com.

Copyright © 2024 by A.M. Best Rating Services, Inc. and/or its affiliates. ALL RIGHTS RESERVED.

View source version on businesswire.com:

https://www.businesswire.com/news/home/20240229868139/en/

Contact

Yi Ding

Senior Financial Analyst

+65 6303 5021

yi.ding@ambest.com

Christopher Sharkey

Associate Director, Public Relations

+1 908 882 2310

christopher.sharkey@ambest.com

Michael Dunckley, CFA

Associate Director, Analytics

+44 20 7397 0312

michael.dunckley@ambest.com

Al Slavin

Senior Public Relations Specialist

+1 908 882 2318

al.slavin@ambest.com

Source : AM Best

Paratus Sciences CEO To Present At Singapore Summit Next Month

KUALA LUMPUR, Feb 29 (Bernama) -- Biotechnology company, Paratus Sciences Corporation announced its Chief Executive Officer (CEO), Theresa Heah will participate in the third BioCentury-BayHelix East-West Biopharma Summit from March 4 to 6, in Singapore.

According to Paratus Sciences in a statement, Dr Heah will participate in a panel discussion titled, “How Will Asia Drive Biotech’s Golden Age?” and present a corporate overview at the conference on March 5.

Headquartered in New York with a subsidiary in Singapore, Paratus Sciences is accelerating the discovery of novel therapeutics by leveraging the extraordinary adaptive biology of bats.

The company is also committed to supporting the bat research community through its division, the Bat Biology Foundation.

-- BERNAMA